Infinity Newsletter, RUNZ & #FastCrypto [01.09 — 01.13]

13 Jan 2023 Market Commentary

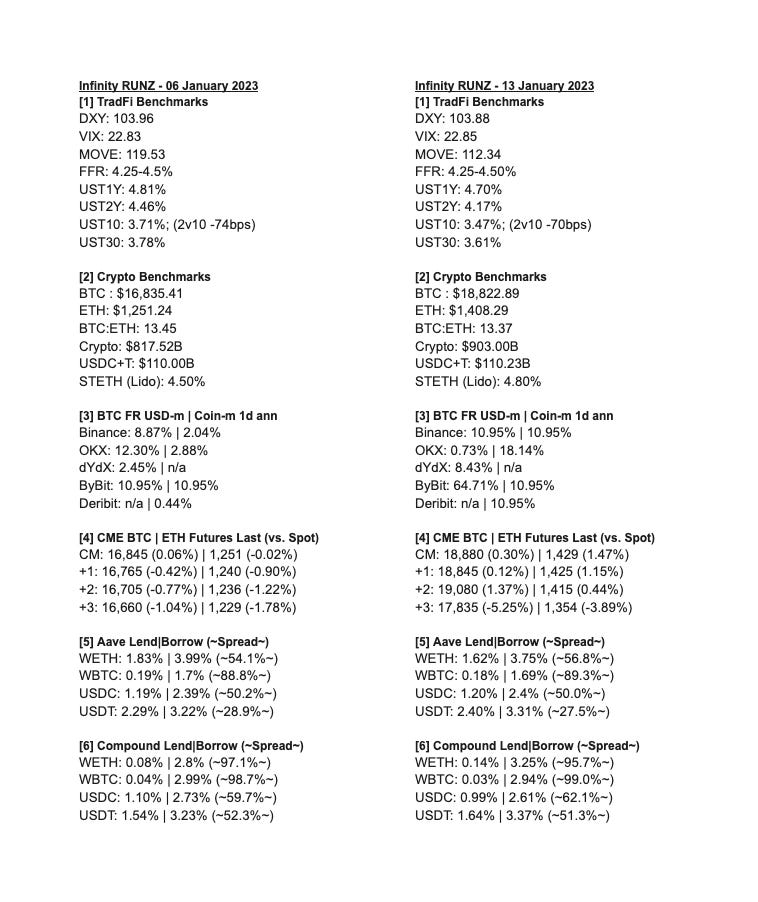

Overall, both crypto and traditional markets saw positive developments, with crypto gaining momentum and traditional markets responding positively to easing headline inflation. BTC has gained for nine straight days, the longest positive streak since 2020, with BTC hovering at $19k and ETH at $1.4k, recovering to pre-FTX levels.

End of week saw two big ‘drops’, with SBF starting his own Subsack, first post being “FTX Pre-Mortem Overview”, which continues SBF’s (virtual) world tour of non-reliance disclaimers, read “Just an Estimate”. SBF should look to one of the thought (blog) leaders: Arthur Hayes commentary. In other, somewhat related news, the SEC charged Genesis and Gemini for their unregulated distribution of earn products. Expect dominoes to ensue.

Bears have started feeling the warmth as February’s FOMC rate hike is now expected closer to 25bps (with chances of a 50bps hike revised down to 8%). As of Friday, CPI figures this, Treasury yield curve inversion that. This is what everyone is talking about, why read our weekly updates?

We’re here to drop what most don’t read, and what even less talk about. LFG.

The past decade’s QE resulted in excessive money printing, which (ironically, yet logically) led to a deficit in bank loan creation (which consists of creating a $ deposit as liability and contra $ loan as asset) in the real economy. Tables turned in 2022 as banks swapped their $ yield-bearing cash & securities (bank assets) into $ yield-bearing real economy loans (bank assets).

In 2022, bank loan creation reached $1.2 trillion, or ~3x greater than levels in recent years. As the Fed adjusted its monetary policy transmission mechanism from the Fed Funds Rate (currently 4.25-4.50) to Interest on Reserves (IOER, where the ‘E’ no longer exists, as the Fed scrapped reserve requirements), banks are now positioned to chase asset (loan interest rate) returns unconstrained by funding (retail deposit rate) costs.

At current, banks benefit from Fed hikes, as they (finally regain) control of their asset returns and funding costs, with a near 100% lever on their NIM gap. This means retail, yet again, needs to find the best borrow rate (bank’s asset return) and be subject to uncompetitive deposit rates (bank’s funding cost). This is only possible as retail is prevented from accessing the only competitor to bank funding costs: the Fed’s reverse repo (RRP) facility rate.

The Fed’s RRP sets a floor under overnight/short-term interest rates, i.e. it’s the most risk-free when it comes to risk-free rates of return. The RRP currently pays a healthy 4.3%, this compared with (at time of writing) the large US banks (Bank of America, Chase, Wells Fargo, Citi) all offering a dry 0.01% APY on retail savings accounts. Why is there no means for retail to access these types of (RRP-like) yields in a single avenue, and not be beholden to the banks? Food for thought.

From a macroeconomic lens, the above is discussed (significantly) more in-depth in Ray Dalio’s Big Debt Crises. Are we headed for a soft landing, or Dalio’s “Beautiful Deleveraging”? Reach out to us or leave a comment.

FastCrypto 01.09.2023

Wyre imposes up to a 90% withdrawal limit for all users

Users can withdraw up to 90% of their crypto funds as the company explores strategic options to circumvent the prolonged bear market.

Pace of Huobi Withdrawals Subsides as USDD Sees Renewed Slide

Justin Sun deposited $100 million worth of stablecoins in the exchange as a show of confidence. The deposit was composed of USD Coin (USDC) and Tether (USDT). The price of Tron’s USDD—has wavered between $0.983 and $0.972 within the past week.

Ethereum developers eye February public testnet for Shanghai upgrade (ETH withdrawals)

The planned Shanghai upgrade of the Ethereum network will focus exclusively on ether (ETH) withdrawals, according to a recent core developers call.

Bitcoin futures activity fell off cliff in December

Futures volumes were just $386.6 billion in December, down 39% month-on-month as they clocked the worst month since October 2020, when volumes were $333.6 billion. CME's open interest of bitcoin futures dropped 11.1% to $1.36 billion by the end of December. Average daily trading volumes of CME bitcoin futures plunged 53.1% to $632 million.

FastCrypto 01.10.2023

Huobi Korea moves to sever ties with the mothership

Huobi's Korean arm is set to sever ties with Huobi Global and run its own business, it will negotiate the ownership of equity. More than half of the existing Huobi Korea was owned by Leon Lin, the founder of Huobi Global.

Metropolitan Commercial Bank to close crypto vertical

The bank’s shift comes a week after a trio of U.S. banking regulators warned about putting too much leverage in crypto. Metropolitan Commercial Bank does not hold crypto on its balance sheet, and does not market or sell crypto assets to customers.

BlockFi said CEO cashed out nearly $10 million as FTX loan stabilized clients

Thanks to a $400 million loan from FTX, CEO Zac Prince was able to withdraw around $9.2 million from BlockFi in April 2022, according to a BlockFi release outlining the progress of its ongoing court case, using the funds to pay taxes. “Due to the structure of the settlement, certain payments from BlockFi were routed through the executives and ultimately made to the counterparty,” according BlockFi.

Nomad exploit wallet address transfers $1.5M to Tornado Cash

An address related to the $190-million Nomad exploit has moved $1.57 million in ETH to Tornado Cash. CertiK flagged the wallet address, suggesting that the attackers may be cashing in the funds. The hacker transferred 12 batches of 100 ETH to the sanctioned mixer.

Hong Kong Firm With Ties to Bitmain Reorganizes to Focus on Crypto Asset Management and Hedging

Nasdaq-listed Dragon Victory International Limited (LYL) is rebranding to Metalpha Technology Holding Limited, the name of its asset management and hedging subsidiary. Metalpha, which offers asset management and hedging services, is a limited liability company, 49% of which was owned by Bitmain-tied financial services firm Antalpha, and 51% of which was owned by Meta Rich Limited, which in turn was 100% owned by Dragon Victory International.

FastCrypto 01.11.2023

Cosmos-based e-Money discontinues euro-backed stablecoin

e-Money stated that it will honor EEUR stablecoin redemptions. Customers with funds below 100,000 EEUR can unwind their positions by swapping their tokens directly on Osmosis for USDC, atom or osmo. Customers who wish to redeem amounts larger than 100,000 EEUR can do so directly for euros.

Ondo Finance launches three tokenized U.S. Treasuries and bonds

These tokenized products let stablecoin holders invest in bonds and treasuries. The three offerings upon launch include the U.S. Government Bond Fund, Short-Term Investment Grade Bond Fund and High Yield Corporate Bond Fund.

Gemini terminates Genesis loans, officially ends Earn Program

Gemini said it will prioritize the return of customer funds and “operate with the utmost urgency.” Existing redemption requests and the capacity of Gemini to seek a resolution to recover its customers assets, are not impacted by the loan agreement's resolution, the company said in its email.

Yearn .finance opens vault deployment access to all users

All users can now create sophisticated Permissionless Vault Factories on its platform. “Our new Permissionless Vault Factory lets anyone deploy an auto-compounding yVault for any Curve pool with an active liquidity gauge. Yes, anyone. Factory-deployed vaults have no management fees and a flat 10% performance fee.

Binance Admits to Problems With Its BUSD Peg

Binance, admitted flaws in its system that left its supply of Binance Smart Chain BUSD. On three occasions between 2020 and 2021, the difference between the amount of Binance-Peg BUSD circulating on Binance Smart Chain and the quantity of real BUSD supposedly backing it eclipsed $1 billion.

FastCrypto 01.12.2023

DeFi startup Quasar Finance raises $5.4 million at a $70 million valuation

Quasar’s protocol allows users to create and join vaults, or independent asset containers capable of connecting tokens and data transfers between chains. The round includes Shima Capital, Polychain Capital, Blockchain Capital, HASH Capital, CIB and Osmosis co-founder Sunny Aggarwal.

Goldman Sachs’ Tokenization Platform GS DAP™, Leveraging Daml, Goes Live

GS announced the new Digital Asset Platform, GS DAPTM, is live– one year into their engagement. Daml-based tokenization platforms, such as GS DAPTM, capture the full complexity of rights, obligations, and cash flows throughout the lifecycles of assets. Additionally, Digital Asset ensures that data is only shared with entitled stakeholders with its privacy protocols while supporting the scalability necessary to connect assets globally.

FTX Restructuring Team Has Clawed Back $5B in Lost Assets

The FTX restructuring team has recovered more than $5 billion in cash, liquid cryptocurrency, and liquid investments in securities, FTX's lead attorney Adam Landis said on Wednesday morning at a court hearing in Delaware. The assets recovered also include “dozens of illiquid cryptocurrency tokens,” and Landis noted that the “holdings are so large relative to the total supply that our positions cannot be sold without substantially affecting the market for the token.”

Hong Kong watchdog aims to restrict retail traders to liquid products

The new licensing program will restrict retail traders in Hong Kong to “highly-liquid” digital assets. The SFC highlighted that they are not planning to “allow retail investors to trade in all of them.” Instead, the SFC will set up criteria that allow retail traders to only trade major virtual assets.

FastCrypto 01.13.2023

Decentralized Lending Protocol Flux Finance Launches, Looks to Support Tokenized US Treasuries

Developed by Ondo Finance, Flux is a decentralized lending protocol that can support both permissionless cryptoassets as well as tokenized securities with transfer restrictions following a peer-to-pool model and is designed to always quote a lend and borrow rate, ensuring constant liquidity.

Alkimiya raises $7.2 million to build 'decentralized capital markets for blockspace'

The round featured 1kx and Castle Island Ventures, Dragonfly, Circle Ventures and Coinbase Ventures. Alkimiya aims to provide hedging solutions for blockspace producers such as miners and staking validators.

Bank of International Settlements outlines policy approaches to ban, contain or regulate crypto

BIS suggests authorities take three different approaches when it comes to crypto: Regulate, contain or call for a complete ban of the sector. The other options would be to isolate crypto from traditional financial economies and to regulate the sector in a way similar to the financial services sector.

Alameda liquidators get liquidated on Aave as they try to consolidate funds

Liquidators lost $72k on Aave after getting liquidated while attempting to recover funds. The liquidators were trying to close the position and in the process first removed the extra collateral used for the position, putting it at risk of liquidation. They also tried to remove large amounts of LDO tokens, not noticing the tokens were still being vested,

SBF's New Substack Blames CZ for 'Quick, Targeted Crash' That Brought Down FTX

With no job and under house arrest, SBF launched a Substack newsletter. In the first post called “SBF’s Substack,” the former FTX CEO blamed Binance's CZ for the demise of Alameda Research.

Nexo Hit by 'Flood of Withdrawals' Following Office Raid Over Money Laundering Investigation

Funds are flowing out of Nexo following news that prosecutors in Bulgaria are investigating the company for fraud.

Our Socials

Website: www.infinity.exchange

Twitter: https://twitter.com/infinitymaxima

Discord: https://discord.com/invite/cb3DW9zMtB

Telegram: https://t.me/infinity_exchange

Get in touch: community@infinity.exchange